How to Safely Order Cryptocurrencies: A Step-by-Step Overview for Beginners

How to Safely Order Cryptocurrencies: A Step-by-Step Overview for Beginners

Blog Article

Exactly How Cryptocurrencies Are Changing International Deals

The emergence of cryptocurrencies notes a significant change in the landscape of international transactions, driven by the guarantee of improved efficiency and inclusivity. As digital money help with quicker and extra affordable cross-border payments, they challenge standard financial systems that have actually long depended on middlemans. This change not just democratizes accessibility to monetary services however likewise elevates concerns about the future regulative setting and the potential for cutting-edge financial products. What implications does this shift hold for organizations and customers alike, and just how might it reshape the very material of international trade?

The Rise of Digital Money

In current years, the increase of digital money has actually transformed the landscape of monetary deals, offering unmatched rate and efficiency. Digital money, especially cryptocurrencies like Bitcoin, Ethereum, and others, have become viable alternatives to standard fiat money. This evolution has been driven by improvements in blockchain modern technology, which supplies a secure, decentralized system for purchases, mitigating dangers related to fraud and manipulation.

The fostering of electronic currencies has actually been sustained by a boosting variety of businesses and consumers acknowledging their possibility. With a growing approval of cryptocurrencies in numerous markets, consisting of retail, financing, and even real estate, the use of digital currency is becoming extra mainstream. Additionally, the surge of Initial Coin Offerings (ICOs) and decentralized financing (DeFi) platforms has actually opened new methods for financial investment and resources raising, more strengthening the function of digital currency in the international economic situation.

Advantages of copyright Transactions

As organizations and consumers significantly embrace cryptocurrencies, the benefits of copyright purchases become much more evident. Among the primary advantages is the decrease of deal fees. Conventional financial systems typically impose high charges for cross-border deals, while cryptocurrencies usually provide much lower prices, making them an eye-catching alternative for both people and companies.

Additionally, copyright transactions are processed swiftly, typically in an issue of mins, no matter geographical barriers. This speed is especially valuable for international trade, where time-sensitive deals can considerably influence service operations. Cryptocurrencies run on decentralized networks, enhancing safety and security and minimizing the risk of fraud. This decentralization also promotes higher openness, as purchases are videotaped on public ledgers, permitting very easy monitoring and verification.

One more significant advantage is financial addition. Cryptocurrencies supply accessibility to monetary services for unbanked populations, allowing people to take part in the worldwide economy without the demand for a conventional checking account. The borderless nature of cryptocurrencies enables for seamless deals across nations, equipping businesses to broaden their markets and consumers to access a bigger variety of goods and services. Overall, these benefits position cryptocurrencies as a transformative force in worldwide purchases.

Obstacles in Adoption

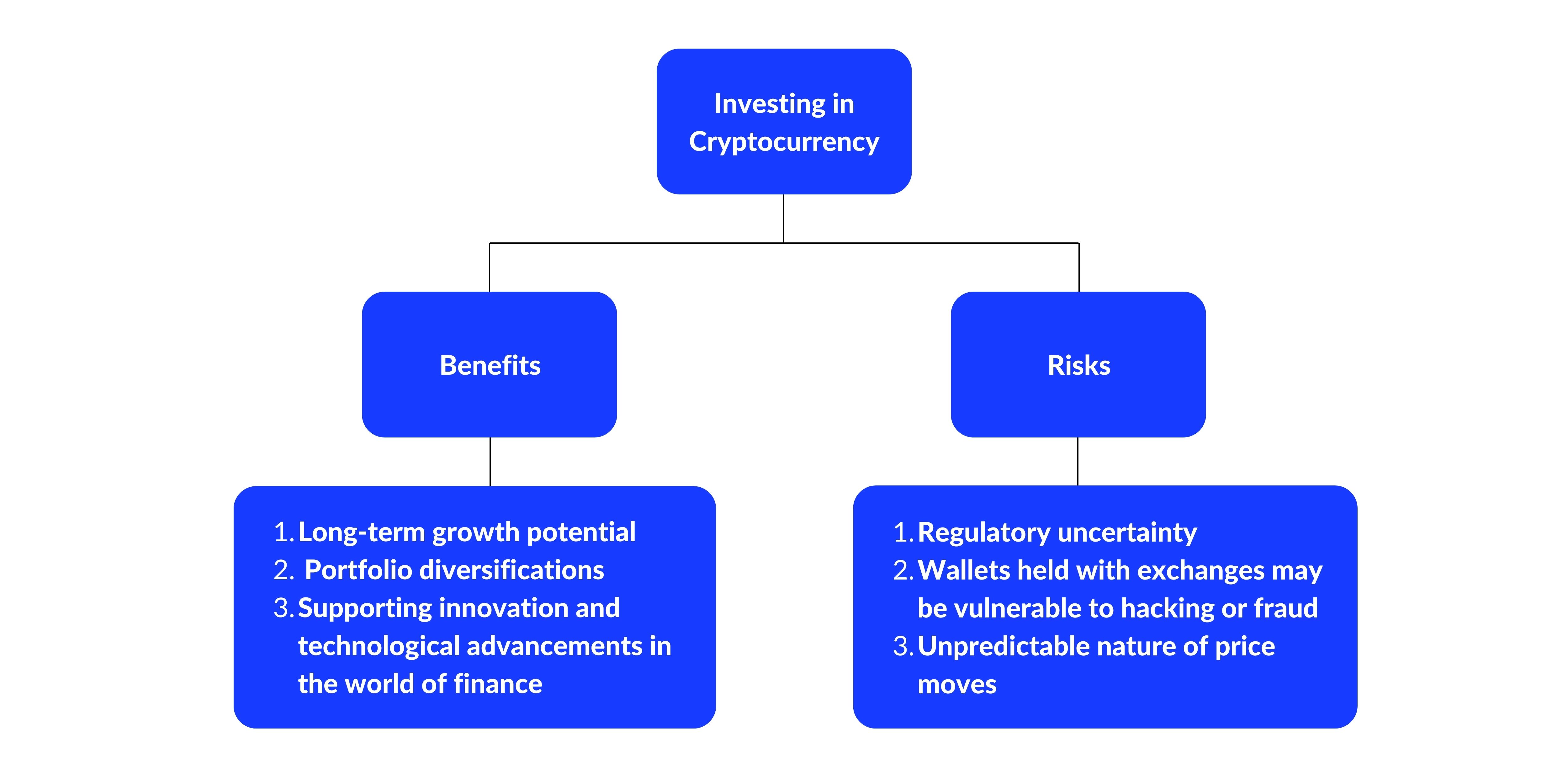

Fostering of cryptocurrencies look what i found encounters several considerable obstacles that prevent their prevalent acceptance. One of the primary obstacles is governing unpredictability. Federal governments globally are still formulating policies to attend to cryptocurrencies, which develops an unforeseeable environment for possible individuals and investors. This uncertainty can deter people and businesses from involving with electronic currencies.

Furthermore, the volatility of copyright worths provides an additional major challenge. The substantial cost variations can bring about substantial financial danger, making it tough for individuals to rely upon cryptocurrencies as a stable cash or store of value. Because of this, many prospective adopters continue to be cynical regarding making lasting investments.

Additionally, the intricacy of copyright technology can be daunting for the average consumer. A lack of recognizing surrounding budgets, personal tricks, and blockchain innovation can pose considerable barriers to entrance. Individuals might really feel overloaded and reluctant to take part in transactions.

Finally, protection worries can not be ignored. Top-level hacks and fraud events have actually elevated doubts regarding the safety of copyright holdings. These problems jointly add to a careful technique amongst prospective adopters, inevitably slowing the combination of cryptocurrencies right into mainstream economic systems.

Effect on Global Profession

Regulative uncertainty, volatility, and safety and security worries bordering cryptocurrencies not just influence individual users but also have significant ramifications for worldwide trade. As services significantly consider incorporating electronic money right into their procedures, the absence of a stable regulatory structure develops difficulties that can hinder cross-border transactions. Business may face difficulties in navigating varying policies throughout territories, causing possible compliance issues and increased functional expenses.

Moreover, the rate volatility fundamental in cryptocurrencies positions risks for global trade agreements. Fluctuating currency exchange rate can influence the value of deals, complicating rates approaches and possibly causing disputes in between trading partners. This unpredictability can deter services from completely embracing cryptocurrencies as a payment technique, especially for large-scale purchases.

Future of Financial Transactions

The future of monetary transactions is poised for transformation, driven by innovations in modern technology and progressing consumer preferences. As cryptocurrencies gain grip, they are most likely to redefine conventional financial systems, enabling faster he said and more cost-efficient cross-border purchases. Decentralized financing (DeFi) systems will assist in peer-to-peer borrowing and borrowing, removing the requirement for intermediaries and lowering transaction costs.

Furthermore, the combination of blockchain innovation will improve openness and safety and security, resolving common issues connected to fraud and information personal privacy. order cryptocurrencies. Smart contracts, which instantly execute agreements when predefined problems are fulfilled, will certainly improve processes in various sectors, consisting of realty and supply chain management

Consumer fostering of electronic money is expected to rise, particularly among more youthful demographics that are more comfortable with technology. This shift may motivate banks to adapt their offerings, integrating copyright services to fulfill market needs.

Verdict

To conclude, cryptocurrencies are essentially transforming global purchases by offering faster, more affordable, and protected payment alternatives. The removal of intermediaries enhances economic inclusion and fosters trust fund via clear public journals. While difficulties in adoption continue to be, the potential for cutting-edge financial options in worldwide trade is useful content substantial (order cryptocurrencies). As the landscape of monetary transactions continues to evolve, cryptocurrencies are positioned to play a vital duty in shaping the future of the international economic climate.

Report this page